Cut Over Plan

Syteline system cut over will be the biggest milestone of your implementation project. Careful planning would be essential to your project success.

Section A – Initial Setup

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| A1 | Groups | Specify groups who are allowed access to the SyteLine ERP system. | |||

| A2 | Group Authorizations (Linked) | Allows the system administrator to set up different levels of access for every group within the SyteLine ERP system. | |||

| A3 | Users | Specify users who are allowed access to the SyteLine ERP system. | |||

| A4 | User Authorizations (Linked) | Allows the system administrator to set up different levels of access for every user within the SyteLine ERP system. | |||

| A5 | General Parameters | Lets you set the parameters used throughout the system. | Small | ||

| A6 | Countries (Optional) | Set up country codes used throughout the system. | Small (add as needed) | ||

| A7 | Prov/States | Set up province/state abbreviations used throughout the system. | Small | ||

| A8a | Currency Codes (Optional) | Maintains currency codes used throughout the system. | Small | ||

| A8b | Currency Conversion Parameter Form (Optional) | Small | |||

| A8c | Currency Rates (Optional) | Small | |||

| A9 | Language Ids (Optional) | Identify the language used in a string table in the forms database. | Small – English is the only supported lanugage |

Section B – General Ledger Setup

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| B1 | Accounting Periods | Maintains the accounting periods used by the General Ledger to post transactions. | Small | ||

| B2 | Account Number Formatting | Allow you to change the General Ledger account number or to respecify the section of the account number to use as the sub-account (or whether to use a sub-account at all). | Small | ||

| B3 | Unit Codes | Used to view, enter, budget, and report financial information by reporting unit, at the account/sub-account level. Sub-accounts are not recommended. | Small | ||

| B4 | Departments | Maintains a list of all departments referenced by work center and employee records. Departments are also linked to Unit code 1 for financial reporting. | Small | ||

| B5 | Chart of Accounts | Defines account numbers, which will be used throughout the SyteLine ERP system to record, track, and report costs. | Small | ||

| B6 | Chart of Account Allocations (Optional) | Routinely distributes an expense among more than one account according to percentages you define. | Small | ||

| B7 | Statistical Accounts (Optional) | Used in financial statements to compare important non-financial data to related financial data for measuring such things as productivity and controlling costs | Small | ||

| B8 | Budgets and Plans (Optional) | Worksheet used to create budgets and plans for each individual account, accounting period, and fiscal year. |

Section C – General Financial Setup

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| C1 | Bank Reconciliations | Keeps a transaction history against all the bank checking accounts your company uses. Also used to define the GL Cash account used when processing payment transactions. | Small | ||

| C2 | Bank Addresses (Linked) | Maintains address information for the banks your company uses. | Small | ||

| C3 | Ship Via Codes | Used to identify the delivery methods available to ship merchandise. | Small | ||

| C4 | Billing Terms Codes | Maintains billing terms used by both customers and vendors. | Small | ||

| C5 | Tax Parameters | Defines global (applying to both tax systems) switches and dates, and to set optional tax data printing options. | Small | ||

| C6 | Tax System | Assign a numerical code to the tax system (ex. 1 = State). | Small | ||

| C7 | Tax Jurisdiction (Optional) | Assign a code to the tax jurisdiction (ex. CO = Colorado). Used only if reporting tax by Jurisdiction. | Small | ||

| C8 | Tax Codes | Used to specify the percentage of tax to charge to a customer and the GL Account to which the tax is to be posted. | Small | ||

| C9 | Product Codes | Allow you to group similar types of items and assign price markups, discounts, GL accounts, tolerance factors, and selection criteria for reports of those groups. Used to group items for financial purposes using reporting units, and to group for general reporting. | Small | ||

| C10 | Fixed Asset Depreciation Tables (Optional) | Used to define custom depreciation methods. Standard depreciation schedules are already built into the system and can only be viewed by displaying help. | Small | ||

| C11 | Bonus Depreciation Codes (Optional) | Used to define additional depreciation. | Small | ||

| C12 | Fixed Asset Parameters | Establishes titles for up to three depreciation schedules. The only one that will be used to post financial transactions is Book. | Small | ||

| C13 | Fixed Class Codes | Enter the identifier for the GL account class being established in the system. It is a user-defined code. | Small | ||

| C14 | Fixed Assets | Maintains all identifying and descriptive information unique to an asset. | Small | ||

| C15 | Fixed Asset Depreciation | Used to define the method in which SyteLine ERP calculates depreciation for each active asset. | Small | ||

| C16 | Fixed Asset Costs | Maintains a comprehensive history of all costs accumulated for an asset. All costs will be used for depreciation purposes, except type “Repair.” | Small | ||

| C17 | Project Default Parameters | Used to enter the GL account numbers that SyteLine ERP will use. | Small | ||

| C18 | Project Types | Used to enter all the codes that classify the project types. | Small |

Section D – Accounts Payable Setup

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| D1 | Accounts Payable Parameters | Define aging buckets, specify the accounts to use in the GL, and provide 1099 information. | Small | ||

| D2 | Payment Hold Reason Code | Explains why you put the current vendor on payment hold. | Small | ||

| D3 | Recurring Vouchers (Optional) | Allow you to generate monthly vouchers for transactions in which the vendor and amount are always the same. | Small |

Section E – Accounts Receivable Setup

| Step | Form | Purpose | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

||

| E1 | Accounts Receivable Parameters | Used to enter the default parameter values SyteLine ERP applies throughout Accounts Receivable. | Small | ||

| E2 | Salesperson Classifications (Optional) | Used to create sales force classifications by region, division, locality, area, and so on. | Small | ||

| E3 | Salespersons (Optional) | Maintains the list of valid salespersons that can be entered for each order header. It is recommended to setup a salesman for either salesman reporting and/or commissions reason. | Small | ||

| E4 | End User Type | Used to classify customers and customer orders and to overwrite Sales, Sales Discounts, Accounts Receivable, and COGS accounts based on the specified end user type. | |||

| E5 | Distribution Accounts | Defines distribution accounts for a grouping of items. | Small | ||

| E6 | Finance Charges (Optional) | Used to enter amounts charged to the customer for their overdue balances. | |||

| E7 | Dunning Report (Optional) | Use Crystal Reports to modify the report output format, adding your company address, a salutation, and introductory and closing text. | |||

| E8a | Credit Hold Reason Codes | Used to define codes used to explain why various customers have been placed on credit hold. | Small | ||

| E8b | Customer Credit Limits | Set credit limits for repeat customers $500k (AZ, Roland DG…) for all others $100k | Small | ||

| E8C | Customer Billing Terms | Define customer specific terms | Small | ||

| Customize Invoice | modify the invoice output format, adding your company address, a salutation, and introductory and closing text. | Medium | |||

| Order Verification | modify the form output format, adding your company address, a salutation, and introductory and closing text. | Medium | |||

| Packing Slip | modify the form output format, adding your company address, a salutation, and introductory and closing text. | Medium | |||

| ProForma Invoice | modify the form output format, adding your company address, a salutation, and introductory and closing text. Make sure Commodity Codes Print | Medium |

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Backup Database before entering Section F (note Parameter forms can be entered, no master data just static data)

Section F – Inventory Setup

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| F1 | Inventory Parameters | Used to set parameters in your inventory system for use throughout the entire SyteLine ERP system. | Small | ||

| F2 | Units of Measure | Used to maintain all units of measure that can be associated with an item. | Med | ||

| F3 | Unit of Measure Conversions | Maintains valid mathematical relationships between units of measure. | Large | ||

| F4 | Family Codes (Optional) | Allow you to classify groups of items for planning purposes. | |||

| F5 | Warehouses | Maintains all warehouses used in the system. | Small | ||

| F6 | Locations | Maintains the list of valid places for inventory. | Small | ||

| F7 | Obsolete/Slow Reason Codes | Used to explain why you are designating an item as obsolete or slow-moving inventory. | Small (Use blank, do not put GL accts, let product code define) | ||

| F8 | Commodity Codes (Optional) | Used to identify various commodities. | Small (figure out how to get them to display) | ||

| F9 | Items | Used to maintain a list of all items bought, manufactured, and/or sold. | Large | ||

| F9 | Items Lead Times and ABC | Set long lead critical items (LEDs, substrates) ABC Code A and then use 3days as generic for all remaining items ABC Code C, custom machined parts 3wks ABC Code B | Large | ||

| F9b | Items-Mfg Name/PN | Enable User Defined Fields in Item Master for this purpose | Med | ||

| F10 | Item Stockroom Locations (Linked) | Used to create a record of every location where an item is to be kept. | Small (If we use one stock location) | ||

| F11 | Item Costs (Linked) | Tracks costs associated with items entered on the Item Maintenance screen. | Large | ||

| F12 | Item Pricing (Linked) | Maintains pricing and pricing options, which can be associated with items. | Medium | ||

| F13 | Item/Warehouse | Adds an item to warehouses in addition to the default warehouse. | |||

| F14 | Lots | Maintains information about lots and their locations. | Small (Use lots to track Feature BOM items or SN???) | ||

| F15 | Item Lot Locations | Maintains information about all lot-tracked items and their locations. | |||

| F16 | Transfer Order Parameters (Optional) | Used to set parameters for transfer orders. | |||

| F17 | Misc. Receipt Reason Codes | Used to track the entry of Miscellaneous Receipt transactions. | Small (Use blank, do not put GL accts, let product code define) | ||

| F18 | Misc. Issue Reason Codes | Used to track the entry of Miscellaneous Issue transactions. | Small (Use blank, do not put GL accts, let product code define) | ||

| F19 | Inv. Adjustment Reason Codes | Use to explain why a quantity adjustment to inventory is needed. | Small (Use blank, do not put GL accts, let product code define) | ||

| F20 | Transfer Loss Reason Codes | Used to explain quantity adjustments to inventory due to transfer losses. | Small (Use blank, do not put GL accts, let product code define) | ||

| F21 | Reservations for Item (Optional) | Used to reserve an item. |

Section G – Purchasing Setup

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| G1 | Purchasing Parameters | Enters default values for use throughout Purchasing. | Small | ||

| G2 | Vendor Categories(Optional) | Used to add categories to assign to your vendors for financial grouping purposes. | |||

| G3 | Vendors | Maintains a record for all vendors with whom your company deals. | Medium (must use AP address) | ||

| G4 | Drop Ship To(Optional) | Used to identify a drop ship address different from the address that appears on the Vendors form. | Enter as needed | ||

| G5 | Vendor/Item Cross Reference | Used to associate items with Vendors; allows the setup of vendor part number to your part number and history. | Large | ||

| G6 | Vendor/Item Pricing | Used to create vendor specific pricing and quantity price breaks, date sensitive | Enter as required for open and new orders | ||

| G7 | Vendor Letter of Credit(Optional) | Used to document letters of credit (LCRs) from your banks to vendors who require them. | |||

| G8 | Purchase Order Requisition Codes | Used to define codes to track the entry of requisitions. |

Section H – Sales/Order Entry Setup

| Step | Form | Purpose | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

||

| H1 | Order Entry Parameters | Used to set default values for customer order entry. | Small | ||

| H2 | Price Codes | A user defined code applying to customers or items. | |||

| H3 | Price Matrix | Allow you to associate a specific Price Code with a corresponding Customer and Item to form a price matrix. | |||

| H4 | Price Formulas | Used to enter a pricing formula from which to calculate the necessary unit prices. | |||

| H5 | Commissions Table Maintenance | Contains commission percentage information for each salesperson. Before this is done, you must first set the labels from the Activities>set labels. Basically, input salesman as the first and commission for the second. This will input the labels used when inputting the commission rates and salesman. | |||

| H6 | Customer Letters of Credit(Optional) | A document from a bank stating that the bank will insure the customer’s payment. | |||

| H7 | Customer Type(Optional) | Using them allows you to sort reports by customer type. | |||

| H8 | Customers | Stores all the relevant information for storing basic customer data and tracking what customers buy from the company, as well as what customers owe. | Small (active customers only) | ||

| H9 | Customer Item Cross Reference | Track and control information about items bought by specific customers, customer specific items, and customer specific pricing. | Enter as new orders come in | ||

| H10 | Item Pricing | Maintains pricing and pricing options, which can be used with items. | |||

| H11 | CO Returns Reason Codes | Used to define codes used to track adjustments to inventory for customer order returns. | |||

| H12 | RMA Parameters | Used to set default values for RMA functions. | |||

| H13 | Problem Codes | Codes used to track and report problems at the order level. | |||

| H14 | Evaluation Codes | Codes used to track and report RMAs at the line item, or individual material, level. | |||

| H15 | Disposition Codes | Used to enter codes at the line item, or individual material, level, which you will use to track and report what happens to material after it has been returned. |

Section I – Manufacturing Setup

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| I1 | Shop Floor Control Parameters | Sets up default policies for scheduling jobs, What-If jobs, and estimate jobs in SyteLine ERP. | Small | ||

| I2 | Shift Codes | Maintains codes that identify particular shifts. | Small | ||

| I3 | Holidays | Used to enter all dates the entire shop floor is not in operation. | Small | ||

| I4 | Resources | Defines resources that perform work on the shop floor. A resource is a non-specific person, machine, or other tool used in at least one step of the manufacturing process. | Small | ||

| I5 | Resource Groups | Used to organize resources that can perform the same function. | Small | ||

| I6 | Work Centers | For viewing and maintaining information about the work centers in the SyteLine ERP system. | Small | ||

| I7 | Current Operations | Maintains routing requirements and costing information for an item. | Large | ||

| I8 | Current Materials | Maintains material requirements, costs, and reference information for an item. | Large | ||

| I9 | Planning Parameters | Enables features and options used throughout the MRP and APS planning functions. | Small | ||

| I10 | Planning Horizon Calendar | Used to enter starting dates for MRP, APS, and master planning horizontal display periods. | Small (use monthly buckets) | ||

| I11 | Forecast | Used to enter a prediction of requirements for an item. | |||

| I12 | Exception Message Priority | Used to filter out messages considered less important when generating the Exceptions Report. | |||

| I13 | ECN Reason Codes | Defines codes used to explain why an engineering change is needed. | |||

| I14 | ECN Priority Codes | Defines codes that establish priority for suggested ECNs. | |||

| I15 | ECN Distribution Codes | Used to create distribution lists to add to the ECN. |

Section J – Human Resources / Payroll Setup

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| J1 | Human Resource Parameters | Used to enter the frequency with which each employee should be reviewed. | Small | ||

| J2 | Position Classification | Used to enter information classifying the employee’s position. | Small – Sales only | ||

| J8 | Employees | Stores all the information necessary for processing and tracking employee payroll, wages, taxes and deductions, and so on. | Small – Sales only | ||

| J10 | Companies | Used to enter basic information about the company and its CEO. | |||

| J11 | Divisions | Used to enter information about the divisions within the company. |

K – Beginning Balances

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| K1 | Inventory | Large | |||

| K2 | AR | ||||

| K3 | AP | ||||

| K4 | Customer Orders | ||||

| K5 | Purchase Orders | ||||

| K6 | Ledger Balances | ||||

| K7 | Open Jobs |

L –Action Items

| Step | Form | Purpose | Owner(s) | Due Date | Scope

(Task Size – Small (<1Day) Medium (<1wk) Large >1wk) |

| L1 | Order and setup for printed checks | Medium | |||

| L1 | Setup and Test Foreign Currency Customers | ||||

| L3 | Projects Module | ||||

| L4 | Write Syteline Work Instructions for Mfg | Large | |||

| L5 | Remove obsolete parts from P&V | Large | |||

| L6 | Background Ques – e.g., Run MRP nightly or weekly | ||||

| L7 | Backup Plan Syteline data | Small | |||

| Test and Setup Customer Profiles – to email invoices etc directly to customer and accounting | |||||

| Setup financial statements | |||||

| Phase 1 Preparation

Cost Roll Ups Roll Current to Standard |

Large | ||||

| Journal Entries – Purge all “Dist” Journals IC, PO, SF |

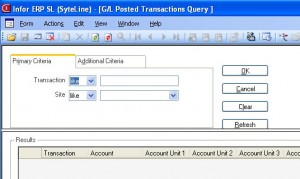

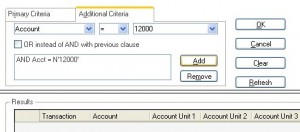

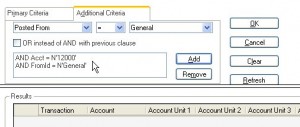

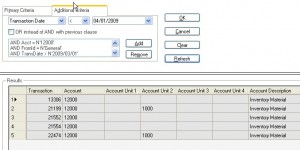

Select “Posted from”, let it “=” to General. That means we will only select transactions that is posted from “General Journal”, instead of normal inventory transactions that are posted from “IC Journal”. Then click the “Add” button.

Select “Posted from”, let it “=” to General. That means we will only select transactions that is posted from “General Journal”, instead of normal inventory transactions that are posted from “IC Journal”. Then click the “Add” button. Right click on left-upper corner of the grid, from the menu, select “To Excel”, you will then be able to export the data to Excel.

Right click on left-upper corner of the grid, from the menu, select “To Excel”, you will then be able to export the data to Excel.

Recent Comments