How to setup an Area Based Tax System

For Businesses operating in Canada:

The Syteline system presumes that the main tax system (GST) will be setup as Tax System 1 with a Tax Mode of either Item or Area depending on the requirement of the province. The Syteline system also presumes that PST and HST will be setup as Tax System 2 with a Tax Mode of Area.

For any European Economic Countries and Australia:

The Syteline system presumes that the main tax system (Sales Tax or VAT Tax) will be setup as Tax System 1 with a Tax Mode of Item.

For the United States:

The Syteline System presumes that the main tax system (Sales Tax) will be setup as Tax System 1 with a Tax mode of Area.

The Parametric Sales Tax System allows the User to set up Tax Systems to change sales tax at the "Item" level or an "Area" level.

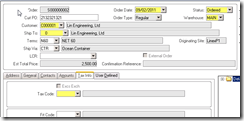

The Area Based Tax System, which applies to U.S. Companies, allow taxes to be charged at the header level, Setting up the Tax Codes entrails assigning tax rates to a State Tax Code. The flags "Include Price" and " Include Misc." Should be set to YES and the A/R tax account number needs to be defined.

Under the Area Tax System, if an item is tax exempt (as specified in the item master), the system will ignore the tax code at the header level and not charge sales tax. If the item is taxable, the system will charge tax based on the "ship to" customer’s tax code ( or the "bill to" if it is the same as the "ship to" customer). If a line item is "dropped shipped", tax will be charged based on the tax code of the "drop ship" customer. This will override the tax status of the line item and the header tax code. If the user wished a message to appear, asking if sales tax should or should not be charged based on the tax code of the drop ship customer, then the following two flags must be set to YES:

"Prompt on Line Item" flag on the Tax System screen. This flag will prompt that the item is taxable or non taxable at the item level of an order.

"Prompt for State Tax" flag on the Tax parameters screen. This flag will prompt that the item is taxable or non taxable in the item master sales screen and page two of the Customer Order Header.

The Item Based Tax System will mainly apply to Canada, UK and European countries. It allows sales tax to be charged at the item level and tax codes to be specified in the item master. (For example, the GST in Canada.) The system will look at the tax rate of the item and override the tax code on the header.

The Parametric Sales Tax System was designed to allow flexibility mainly for the European Community. Many of the fields and flags should be ignored ( or set to "NO") for U.S. Countries.

The following fields give a brief description of what all is involved with the tax structure. The fields with a * indicate they are relevant for the AREA based tax system ( U.S. Countries.)

I. GENERAL PARAMETERS:

-

EC Reporting: "Y" Activates EC VAT information.

-

ED Weight Conversion Factor: Converts Weight field in item file to kilograms ( unit weight on EC SSD.)

-

Capitalize State: "Y" – Upper Case

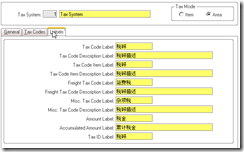

II. TAX SYSTEMS: (File, System, TS) – Can have both tax systems working simultaneously.

-

AREA (US Business) – allows tax rates to be entered at the header level.

-

ITEM (European/ UK) – only allows tax rates to be entered at the item level. (Taxes based on each item of the sale -VAT.)

-

PROMPT ON LINE ITEM- Will show the item is taxable or not at the item level of an order. Will also give y/n message to change "drop ship" tax codes per line item.

-

PROMPT TAX CODE LABEL- Allows use of set up labels ( header).

-

PROMPT TAX CODE ITEM LABEL- Allows use of set up labels (item).

-

PROMPT AMOUNT LABEL- Allows use of set up labels (amount).

-

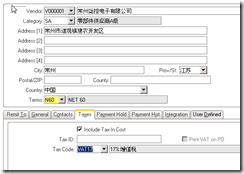

TAX ID LABEL- (ex: Federal ID# on Vendor Screen)

-

ACTIVE FOR PURCHASING- Can turn off Purchasing Side (normally "No"). Can be edited at the distribution level. (Primarily used for EC).

-

USE WHOLESALE PRICE- Will cause a secondary Unit Price Field to be displayed/updated on the Item Master screen. (Calculates taxes in place of the "real" item master unit price.) Wholesale price used first.

-

APPLY TO PROGRESSIVE BILLING- Indicates if taxes should be billed during Progressive Billing.

-

RECORD ZERO RATED- "Y" if it is necessary to record/report transactions which have a tax amount of zero. (May be used for later reporting.) Ex: Selling children’s clothing (textile industry.)

-

TAX ID PROMPT LOCATION- Enables/Disables prompting for the Tax ID on Customer/Vendor screens. (C,V,B)

-

DEFAULT ITEM TAX CODE- Used for new items entered into the Item Master.

-

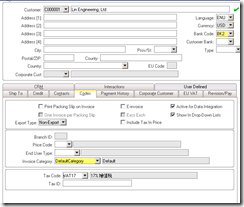

AR/AP TAX CODE: Tax Code = That of the Customer Vendor.

-

FREIGHT/MISC. TAX = AR/AP Tax Code default.

-

DEFAULT CUST/VEND TAX CODE – Default for Customer/Vendor Screen.

-

COMMISSION TAX CODE – That default rate will calculate tax on commissions.

-

NON A/P TAX CODE – Will default to what is filled in for Non-A/P Payments.

III. TAX PARAMETERS

- Set to company’s specific reporting and functionality requirements.

- STARTING TAX PERIOD DATE – Stores the dates following the last submission of the VAT return and SSD report.

Usual Field Values For US:

- CASH ROUNDING FACTOR = 0 (If >0, "Cash Only Flag" is prompted on Billing Terms screen. "Y" will round final invoice to the nearest cash rounding factor.)

- PROMPT FOR TAX DISC. = NO; if yes, will prompt to only pay taxes on the final amount they are paying (after discount). Must apply to the Taxing Authority to qualify.

- PROMPT FOR PRICE INCL. TAX = If YES, tax is fixed in price when invoice is posted.

- PRINT TAX CODES ON INVOICE = "Y" prints tax codes on invoices.

- PRINT TAX FOOTER ON INVOICE = "Y" prints a Tax summary on invoices.

- *PROMPT FOR STATE TAX: YES – Will prompt for if an item is taxable/non-taxable in the item master. Will also give Y/N message to change "drop ship" tax codes per line item.

- TWO EXCHANGE RATES -Used for Multi-Currency.

IV. TAX JURISDICTIONS

Used to record where taxes are located. Allows the user to group the tax codes into Jurisdictions. Each tax code can be assigned a Jurisdiction. Ex: EC = FR (France UK) Tax ID in France. (Not applicable in US.)

V. TAX CODES

1 Set of Tax Codes per Tax System. * Choose between E (Exemption) or R (Rate).

- TAX AT ITEM LEVEL: (Item Master, Sales)

- TAXABLE BLANK: Taxed at Rate that is on the header (Tax Code Type = E (Exemption) or N – Not Taxable – That line item will not be taxed.)

- HEADER BLANK- Individual items get taxed at the rate set by the Tax Codes at the item level.

- HEADER-ZERO – Entire order is presumed tax exempt.

- ASSESS ON RETURN – Active for Vouchers. Indicates tax was never paid on the item and must be assessed at the time of return.

- DEDUCTIBLE – Active for Vouchers. Indicates that the item purchased is deductible from taxes. (i.e. Syteline user is not the end user of the item.)

- INCLUDE PRICE, DISC., FRT., MISC. – Y/N – What amount should be taxes?

- INCLUDE PRICE ON PREV. SYSTEM – Causes the tax amount calculated on Tax System 1 to be added to Tax System 2.

* Tax Account # must be entered.

Recent Comments